Welcome to the world of personal finance! Sometimes, talking about money can feel complicated, but it doesn’t have to be. This guide, based on our book “A Beginner’s Guide to Personal Finance,” will walk you through simple steps to understand and manage your money better. Let’s get started on your journey to financial well-being! (Watch Full Lecture on YouTube: Personal Finance Complete Guide: Manage Money, Save & Invest)

(Keywords: personal finance guide India, money management for beginners, financial planning for beginners)

Understanding Where Your Money Goes: Budgeting Basics

Ever wonder where your hard-earned money disappears each month? That’s where budgeting comes in. Think of a budget as a simple plan for your money. It helps you see how much you earn and where it’s all going.

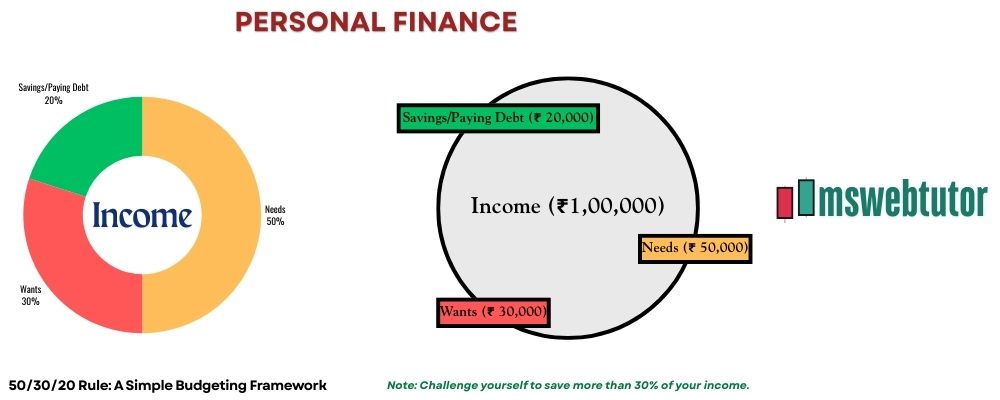

The 50/30/20 Rule: Keep it Simple

A great way to start budgeting is with the 50/30/20 rule. Imagine dividing your after-tax income into three buckets:

- 50% for Needs: These are essential things you must pay for, like rent, food, transportation, loan payments, and basic utilities.

- 30% for Wants: These are things you’d like to have but can live without, like eating out, entertainment, hobbies, and the latest gadgets.

- 20% for Savings and Debt Repayment: This part is for your future! It includes saving for goals, investing, and paying off any debts you might have faster.

Let’s See an Example:

If you take home ₹30,000 per month, according to the 50/30/20 rule:

- ₹15,000 would go towards your needs (50%).

- ₹9,000 could be used for your wants (30%).

- ₹6,000 should be directed towards savings and paying off debt (20%).

How to Calculate Your Own Budget:

- Track Your Income: Know exactly how much money you receive after taxes each month.

- List Your Expenses: Write down everything you spend money on. You can use a notebook, a spreadsheet, or a budgeting app.

- Categorize Your Expenses: Decide which expenses fall into the “needs,” “wants,” and “savings/debt” categories.

- Adjust and Plan: Look at your categories. Are you spending too much on wants? Can you save more? Your budget is a working plan, so adjust it as needed to meet your financial goals.

(Keywords: 50/30/20 rule India, simple budgeting tips, how to make a budget)

Saving for a Brighter Tomorrow

Saving is like building a safety net for your future. It helps you handle unexpected costs and reach your dreams.

What Are Your Savings Goals?

Think about what you’re saving for. It could be:

- An emergency fund (money for unexpected situations like job loss or medical bills).

- A down payment for a car or a house.

- Education expenses.

- A vacation.

- Your retirement.

Having clear goals makes saving easier and more motivating.

Make Saving a Regular Habit:

The key to successful saving is consistency. Even saving a small amount regularly can add up over time. Try to automate your savings by setting up a recurring transfer from your bank account to your savings account each month.

(Keywords: importance of saving money, savings goals India, how to save regularly)

Investing: Making Your Money Grow

Investing is how you can make your money work harder for you. Instead of just sitting in a savings account, your money has the potential to grow over time.

Getting Started with Investing (It’s Not as Scary as it Sounds!):

For beginners in India, there are many ways to start investing. We’ll touch on some common options later. The important thing is to start with what you’re comfortable with and learn as you go.

The Magic of Compounding:

Imagine planting a seed. Over time, it grows into a plant, which can then produce more seeds. Compounding is similar. When you invest, your earnings can also earn money over time. This “interest on interest” can significantly increase your wealth in the long run.

The Rule of 72: A Quick Way to See Your Money Double

Want a rough idea of how long it might take for your investment to double? Use the Rule of 72. Simply divide 72 by the annual interest rate (or expected return) of your investment.

For example, if your investment is expected to grow at 8% per year, it might take around 72 / 8 = 9 years to double.

How Compounding Works: An Example

Let’s say you invest ₹10,000 with an annual return of 10%.

- Year 1: You earn ₹1,000 (10% of ₹10,000), and your total becomes ₹11,000.

- Year 2: You earn ₹1,100 (10% of ₹11,000), and your total becomes ₹12,100.

- Year 3: You earn ₹1,210 (10% of ₹12,100), and your total becomes ₹13,310.

See how your earnings also start earning? That’s the power of compounding! & That is the time value of compounding.

(Keywords: what is investing for beginners, power of compounding India, rule of 72 explained)

Different Ways to Invest in India:

There are various investment options available in India, each with its own level of risk and potential return:

- Fixed Deposits (FDs): A safe option where you deposit a fixed amount for a fixed period at a set interest rate.

- Stocks (Shares): Buying a part of a company. Can offer high returns but also comes with higher risk.

- Bonds: Lending money to the government or a company. Generally considered less risky than stocks.

- Mutual Funds: A way to invest in a mix of stocks, bonds, and other assets managed by a professional. Good for diversification.

- Exchange Traded Funds (ETFs): Similar to mutual funds but traded like stocks on an exchange.

- Real Estate: Investing in property. Can be a significant investment with potential for appreciation and rental income.

- REITs (Real Estate Investment Trusts) and Real Estate Mutual Funds: Indirect ways to invest in real estate.

- Commodities: Investing in raw materials like gold, silver, and oil.

- Cryptocurrencies (Crypto): Digital or virtual currencies. Highly volatile and risky.

Beyond these various investment avenues, some individuals explore more active strategies within the stock market with the aim of generating online income. To delve deeper into one such approach, check out our guide: Make Money Online in Stocks: Your Guide to Breakout Trading and Smart Investing.

Diversification: Don’t Put All Your Eggs in One Basket

A key principle in investing is diversification. This means spreading your investments across different asset classes (like stocks, bonds, and real estate) to reduce risk. If one investment doesn’t perform well, others might help balance out your portfolio.

Long-Term Investing:

For most beginners, a long-term investing approach is recommended. This means holding your investments for several years, allowing them time to grow and ride out any short-term market fluctuations.

- Buy and Hold: A simple strategy where you buy good investments and hold onto them for the long term.

- SIP (Systematic Investment Plan) vs. Lumpsum: For mutual funds and stocks, you can invest a fixed amount regularly (SIP) or a large amount at once (lumpsum). SIPs can help average out your purchase price over time.

- Rebalancing: Periodically adjusting your portfolio to maintain your desired asset allocation (the mix of different investments).

FD vs. Stock Market:

FDs are generally safer but offer lower returns compared to the stock market, which has the potential for higher returns but also carries more risk. The best choice depends on your risk tolerance and financial goals.

Your Savings Account: Is Your Money Just Resting?

While a savings account is important for emergencies, keeping too much money there for the long term means you’re likely missing out on potential growth through investing.

(Keywords: investment options India for beginners, types of mutual funds, what are stocks and bonds, diversification in investing)

Managing Debt Wisely

Debt can be helpful in some situations (like a home loan for a valuable asset), but it can also become a burden if not managed properly.

Good Debt vs. Bad Debt:

- Good Debt: Often associated with assets that can increase in value or generate income over time, like a home loan or an education loan, or a business loan (if it leads to higher earning potential).

- Bad Debt: Typically used for consumable items or things that don’t appreciate in value, like credit card debt with high interest rates or personal loans for non-essential purchases.

The Cost of Borrowing: Why Interest Rates Matter:

Interest rates are the cost of borrowing money. High interest rates can make debt very expensive over time. Always compare interest rates before taking on any debt.

Credit Score:

Your credit score is a number that reflects your creditworthiness – how likely you are to repay borrowed money. A good credit score is important for getting loans and credit cards with favorable interest rates. Pay your bills on time and manage your debt responsibly to maintain a good credit score.

Break Free: Paying Off Debt Fast:

If you have high-interest debt, make a plan to pay it off as quickly as possible. Strategies like the debt snowball or debt avalanche can help you tackle your debt effectively.

(Keywords: good debt vs bad debt, importance of credit score India, how to pay off debt fast)

Planning for Your Retirement

It might seem far away, but retirement planning is crucial, no matter your age. You’ll want to have enough money to live comfortably when you stop working.

Estimating Your Retirement Needs:

Think about how much money you’ll need each month in retirement to cover your living expenses.

Key Retirement Savings Options in India:

- Provident Funds (PF): A mandatory savings scheme for salaried employees in India.

- Pension Plans: Various government and private pension schemes are available.

- Other Savings Options: You can also use your investments (like mutual funds and stocks) as part of your retirement plan.

(Keywords: retirement planning India, provident fund India, pension plans India)

Financial Planning for Specific Goals

Beyond the general principles, it’s important to plan for specific life goals:

- Planning for Education Expenses: Start saving early if you plan to fund your or your children’s education.

- Planning for Homeownership: Saving for a down payment and understanding the costs involved in buying a home are crucial.

- Planning for Other Major Life Events: This could include weddings, starting a business, or other significant expenses.

SWP (Systematic Withdrawal Plan):

An SWP is a way to withdraw a fixed amount of money regularly from your investments (like mutual funds). This can be useful for generating income in retirement or for other financial goals.

(Keywords: financial planning for goals, saving for education India, buying a home India, systematic withdrawal plan)

Insurance: Protecting Your Future from the Unexpected

Insurance is like a shield that protects you and your family from financial hardship in case of unexpected events.

Types of Insurance:

- Health Insurance: Covers medical expenses.

- Term Life Insurance: Provides financial support to your family if you pass away.

- Property Insurance (Home/Auto): Protects your property from damage or loss.

- Disability Insurance: Provides income if you become unable to work due to disability.

How to Choose the Right Insurance Coverage:

Assess your needs and compare different policies to find the coverage that’s right for you and your family.

(Keywords: importance of insurance India, types of health insurance, life insurance explained)

The Psychology of Money: Your Mind Matters

Managing money isn’t just about numbers; it’s also about how you think and feel about it. Understanding your psychology of money is key to making better financial decisions.

- Your Feelings About Money: Recognize how your emotions influence your spending and saving habits.

- Things That Make Money Hard: Be aware of common mental obstacles like impulsive buying or fear of investing.

- Building a Better Relationship with Money: Practice mindful spending, set clear goals, and learn continuously about personal finance.

(Keywords: psychology of money India, financial mindset, overcoming spending habits)

Your Journey to Financial Well-being Starts Now

Congratulations on taking the first step towards a brighter financial future by reading this guide! Remember that personal finance is a journey, not a destination. Keep learning, stay consistent with your efforts, and don’t be afraid to seek help when you need it. By applying these principles, you can take control of your money and build the secure and fulfilling life you deserve. For more information, contact us.

(Keywords: financial freedom India, personal finance tips, money management advice)

Disclaimer: This blog page provides general information on personal finance for educational purposes only. It is not intended as financial advice. Please consult a qualified financial advisor for advice tailored to your specific situation. You can find our full disclaimer page here.